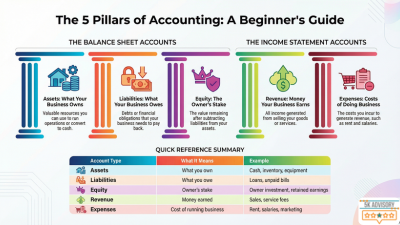

Understanding the 5 types of accounts is one of the most important skills for small business owners, students, or anyone learning accounting basics. These five categories — assets, liabilities, equity, revenue, and expenses — are the backbone of every financial statement and help you track where money comes from and where it goes.

Let’s break them down in a way that’s easy to understand, with examples you can relate to.

What Are the 5 Types of Accounts?

The five main account types are:

- Assets

- Liabilities

- Equity

- Revenue (Income)

- Expenses

These are the backbone of every financial statement, from balance sheets to income statements. Understanding them is the first step to confident financial management.

1. Asset Accounts – What You Own

Assets are resources your business owns that have value. Think of anything you can use to run your operations or convert to cash.

Examples:

- Cash in your bank account

- Inventory (products you sell)

- Equipment or office furniture

Why it matters: Knowing your assets helps you understand your company’s true value.

Quick tip: Assets are usually listed on your balance sheet, and they always increase when you gain resources.

2. Liability Accounts – What You Owe

Liabilities are debts or obligations your business needs to pay.

Examples:

- Business loans

- Credit card balances

- Unpaid bills to suppliers

Why it matters: Tracking liabilities prevents surprises and helps you plan for repayments.

Quick tip: Liabilities also appear on your balance sheet and increase when you take on new obligations.

3. Equity Accounts – Owner’s Stake

Equity represents the owner’s share of the business. It’s what remains after subtracting liabilities from assets.

Examples:

- Owner’s investment in the business

- Retained earnings (profit kept in the business)

Why it matters: Equity shows your personal stake and the overall financial health of your company.

Quick tip: Equity can increase when the business earns profit or when you invest more money into it.

4. Revenue Accounts – Money You Earn

Revenue is the money your business earns from selling goods or services.

Examples:

- Sales from a coffee shop

- Service fees for consulting or freelancing

- Online product sales

Why it matters: Revenue is the starting point of profit calculation. The higher your revenue, the more money your business can reinvest or save.

Quick tip: Revenue accounts are listed on your income statement, not your balance sheet.

5. Expense Accounts – Cost of Running Your Business

Expenses are the costs incurred to run your business and generate revenue.

Examples:

- Rent and utilities

- Employee salaries

- Marketing or advertising costs

Why it matters: Keeping track of expenses helps you control spending and identify areas to save money.

Quick tip: Expenses are also on the income statement and reduce your profit.

Quick Table Summary | 5 Types of Accounts in Accounting

| Account Type | What It Means | Example (Small Business) |

|---|---|---|

| Assets | What you own | Cash, inventory, equipment |

| Liabilities | What you owe | Loans, unpaid bills |

| Equity | Owner’s stake | Owner investment, retained earnings |

| Revenue | Money earned | Sales, service fees |

| Expenses | Cost of running business | Rent, salaries, marketing |

How These Accounts Work Together

Here’s a simple example:

- You sell $500 worth of coffee. Cash (asset) goes up $500, and revenue also goes up $500.

- You pay $200 for rent. Cash (asset) goes down $200, and expense increases $200.

This is the basic flow of money and how accounts interact. Knowing this makes bookkeeping and financial reporting much easier.

FAQs | 5 Types of Accounts in Accounting

Do I need all five account types for a small business?

Yes! Even freelancers and solo entrepreneurs benefit from tracking assets, liabilities, equity, revenue, and expenses. It keeps your financial picture clear.

Where do these accounts appear?

- Balance Sheet: Assets, Liabilities, Equity

- Income Statement: Revenue, Expenses

Can I manage these accounts without an accountant?

Absolutely. Many small business owners use simple accounting software like QuickBooks or Xero to track these five account types.

Final Thoughts | 5 Types of Accounts in Accounting

Mastering the 5 types of accounts is the foundation of good financial management. Once you understand them, you’ll:

- Track money accurately

- Make smarter business decisions

- Prepare for taxes or audits confidently

- Understand your true financial health

Start by reviewing your current accounts, categorize them correctly, and you’ll see your financial picture clearly — no guesswork needed.